The construction sector is a cornerstone of the EU economy. It contributes around 9% of the EU’s GDP and provides direct employment to 18 million people and indirectly supports 24.2 million jobs. This sector in the EU is made up of approximately 5.3 million businesses, with over 99% of them being small and medium-sized enterprises (SMEs).

This highlights its significant role in driving economic growth and providing employment opportunities across Europe. But, its impact extends beyond economics, addressing critical social, climate, and energy challenges.

KEY CHALLENGES FACING THE CONSTRUCTION SECTOR IN EUROPE.

Improving Environmental Sustainability

◆ Aging Building Stock: Many buildings in Europe are old, leading to high energy consumption.

◆ Implementing new technologies and methods to improve productivity and sustainability.

◆ Low Renovation Rates: Increasing the rate of renovations is crucial to improve energy efficiency and reduce emissions.

According to Arthur D.litte, the renovation of 35 million buildings by 2030 presents a tremendous opportunity for the European construction sector. This ambitious goal is part of the EU’s broader strategy to improve energy efficiency and reduce carbon emissions, aligning with the European Green Deal.

◆ Promoting Energy Efficiency.

◆ Reuse and Recycling: Encouraging the use of recycled materials and reducing waste can help create a more sustainable construction ecosystem.

Complexity of Supply Chains

Dependence on Energy-Intensive Inputs: The construction sector relies heavily on materials like steel, glass, aluminum, cement, and various chemical products, which are energy-intensive to produce.

Supply Chain Management: Improving the efficiency and sustainability of supply chains is essential to reduce the overall environmental footprint.

Workforce Availability and Skills

◆ Construction requires a large workforce, but there is a shortage of skilled labor.

◆ Aging Workforce: Many experienced workers are retiring, creating a gap that needs to be filled.

◆ Attracting Younger Workers: Making the construction industry more attractive to younger generations through training programs and career opportunities is vital.

The large-scale skills partnership for construction under the EU Pact for Skills is a crucial step towards addressing the evolving needs of the construction sector. By aiming to train at least 30% of the workforce by 2030.

While the major construction and public works companies are well-equipped to carry out this transformation, subcontractors and the whole fabric of SMEs and ETIs remain under pressure. Access to training is much easier for these companies, as is investment in cleaner vehicles (because a major part of the construction industry’s carbon footprint lies in the transport of materials).

Bouygues Construction, for example, communicates extensively on this point with the implementation of a “climate strategy”. The roll-out of their in-house “Climate Action” training program continues, with 43% of employees already trained.

FOCUS ON THE SITUATION IN EUROPE

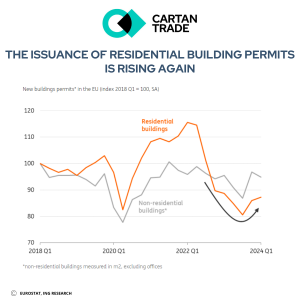

According to ING’s latest report, the European construction volumes are expected to see a decline of about 1.5% this year due to high interest rates and rising building costs. This is a down on ING’s previous forecast (-0.5%), mainly because of revised Eurostat data. However, the outlook for next year is more optimistic.

The production of building materials is beginning to show signs of recovery, likely driven by improvements in supply chains and increased demand for renovation and infrastructure projects.

Renovation is becoming a focal point in the construction sector.

Beyond new homes or new infrastructures, the RMI market (Repair, Maintenance and Improvement) is also key in the construction sector. “RMI market remains under pressure as cost of living continues to impact people’s large expense decisions”, explains Gael Umano, UK Risk Underwriter & Deputy Group Risk at Cartan Trade. RMI data is important to follow to better understand current trend and impact it can have on the smaller and medium size construction firms.

According to Eurostat, from 2021 to 2026, the building renovation market in Europe is estimated to increase by 55.6 billion $.

Despite the temporary disruptions caused by the Covid-19 pandemic and the energy crisis, the outlook for residential energy efficiency and sustainability upgrades could be promising. However, Cartan Trade is rather cautious about the short-term impact of the easing of interest rates and the ending of certain government subsidies (such as the PTZ in France).

FOCUS BY COUNTRY

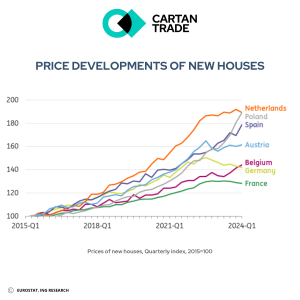

The varying trends in house prices across the EU.

◆ Poland and Spain have seen significant increases in the prices of newly built homes recently.

◆ In contrast, France and Germany are experiencing declines in house prices for both new builds and existing homes.

◆ The Netherlands has also seen a slight decline in new house prices in the first quarter of this year.

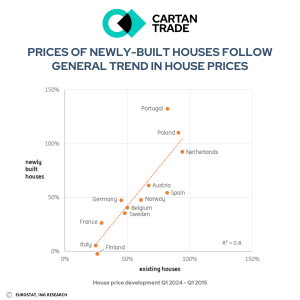

The housing market in many EU countries is experiencing a resurgence in prices after a period of decline.

◆ In Poland, the prices of existing homes increased by over 4% in the first quarter of the year.

◆ Similarly, Spain and the Netherlands saw house prices rise by 2% during the same period.

◆ On the other hand, Germany, facing a more sluggish economic situation, experienced a decline in house prices by 1.1%.

According to Christophe Pennellier, Senior VP & Chief Risk Officer of Cartan Trade, the construction market remains under pressure and highly exposed to insolvencies (it was the sector that saw the biggest increase in insolvencies in 2024, particularly in France).

Indeed, the consumer market is still sluggish, pending the interest rate cut that is stifling the market. But the expected easing of interest rates will only allow for a very slow recovery in activity.

A significant upturn in building permits over a considerable period will be necessary to foresee a recovery of the entire sector.

CARTAN TRADE KEY FACTORS TO EVALUATE BUYERS’ FINANCIAL HEALTH

Gael Umano highlights several key factors that Cartan Trade, as a credit insurer, analyzes for large construction companies:

◆ Dependency to legacy contracts : Assessing the financial health of the company through the weight of legacy contracts, especially those with fixed prices, can pose significant challenges in a high or medium inflation environment.

A very recent case in the UK: ISG which filed for administration on the 19/09, blaming those legacy contracts for its failure. This is the largest construction bankruptcy in the UK since Carillion in 2018. ISG was around £2bn of turnover and about 2,000 employees.

◆ Level of Debt: High levels of debt in the construction sector can be particularly challenging when interest rates remain elevated.

◆ Structure of growth: Numerous construction companies are chasing growth at the expense of margins.

◆ Quality of the Order Book: The quality of a construction company’s order book is crucial, especially in terms of how contracts are negotiated (Fixed-Price or Inflation-Indexed Contracts).

In the years ahead, it will be also important to keep a close eye on the level of investment committed to transforming these companies and tackling their main challenges, as well as their level of debt.

By evaluating these specific factors, Cartan Trade can better analyze the financial resilience of construction companies and provide meaningful highlights to our customers to secure their trading.

Contact us for more about our credit insurance solutions.